Surveys Show COVID-19 is Slowing Down Universal Access to Energy

Off-grid solar (OGS) has been instrumental in increasing electricity access globally. According to the 2020 Market Trends Report, solar home systems and mini-grids were serving 420 million people by the end of 2019. Companies in OGS were moving to new locations to electrify undeserved populations. Projections showed that the sector could serve 823 million users by 2030. However, the progress and the projections are now threatened by the Covid-19 pandemic. Ecosystem players such as industry associations, financiers and other support organisations conducted surveys to find out how the global pandemic was affecting OGS companies and their consumers. This article presents a summary of the main surveys carried out since March 2020 at two levels – industry and consumer, followed by a brief analysis of the findings.

INDUSTRY INSIGHTS

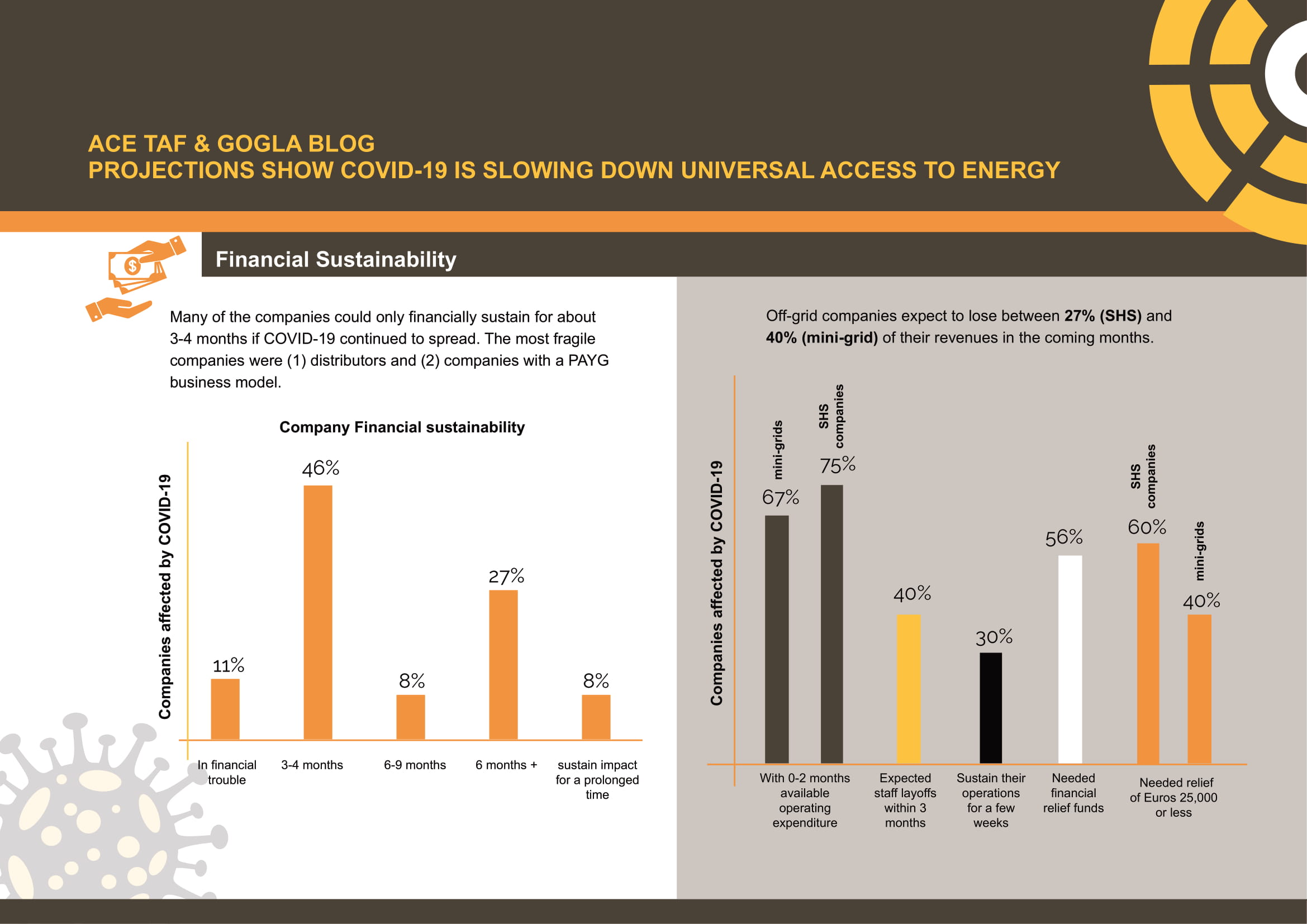

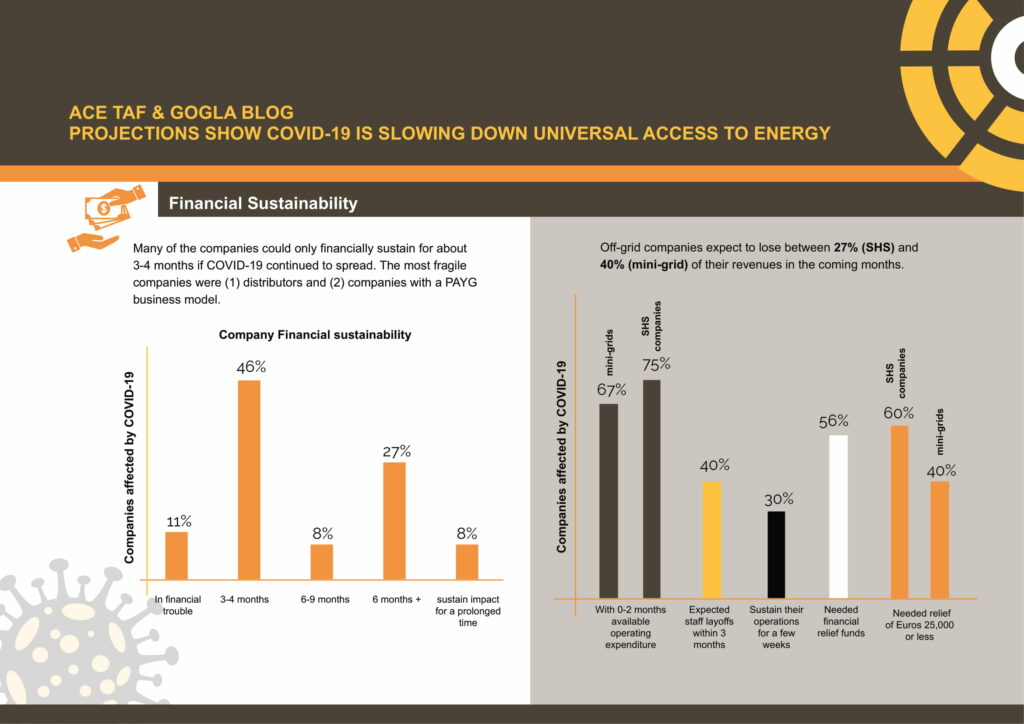

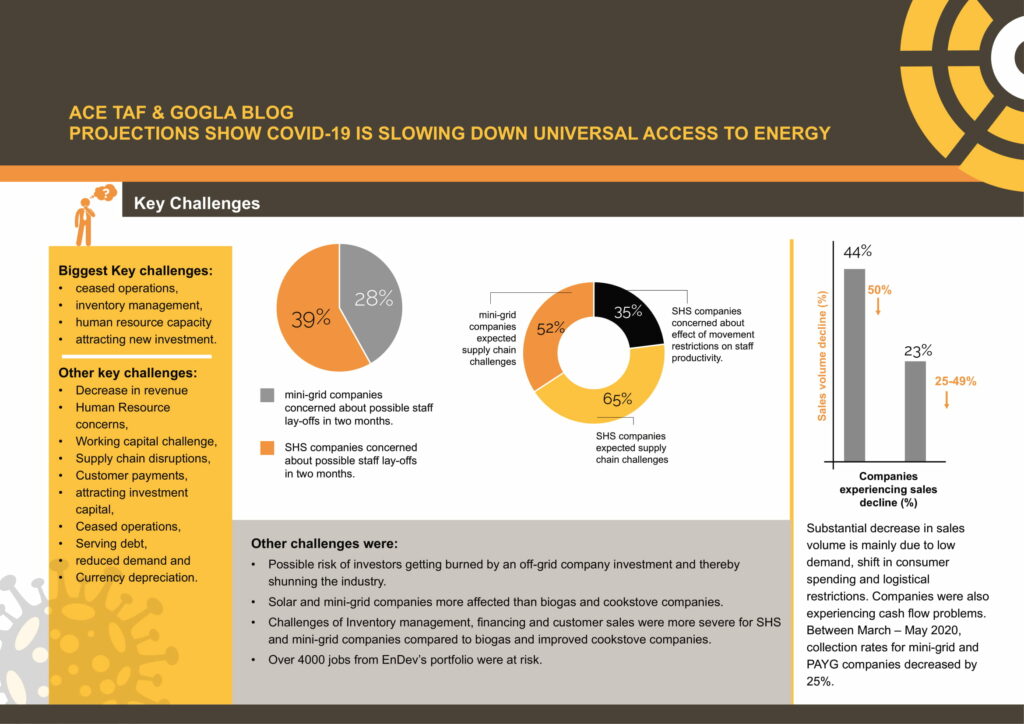

Access to off-grid lighting is threatened as companies are in financial distress

CONSUMERS’ ABILITY TO PAY HAS BEEN AFFECTED

60 Decibels carried out a survey in Kenya, Uganda, Cote d’Ivoire, Nigeria, Rwanda and Zambia among 5,368 consumers of PAYG companies via phone interviews, between May – July 2020.

Key findings:

- 94% of consumers acknowledge that their lives have improved since they purchased the SHS product(s).

- 90% of the companies did not offer any financial support or repayment flexibility to consumers since the start of the pandemic. Where companies availed financial support, 69% of consumers used it.

- Only 25% of consumers were coping with the pandemic. 75% felt vulnerable. The level of vulnerability reduced from 75% in May to 68% in July. Up to 50% of those feeling extremely vulnerable have had their repayments affected during the pandemic.

- For 86% of the consumers the financial situation of their families became worse after the pandemic, compared to before. Incomes of at least 67% of the consumers decreased, but the situation improved slightly in July, with only 49% of consumers reporting decreased income the previous month. 60% of consumers resorted to using their savings, though only 35% had savings. 63% have had to borrow from family or friends to cope with the Covid-19 situation.

- For 34% of the consumers, repayments for their SHS products have been affected (male – 32%, female – 39%). 36% of those affected live in rural areas, while the rest live in towns or cities.

- 53% of consumers feel the repayments are a burden to them, with 19% indicating they are a heavy burden.

SDG 7 IS AT GREAT RISK

- There has only been one major survey on consumers. The survey by 60 Decibels shows that 47% of pay-as-you-go consumers have kept pace with their repayments. However, 53% of the consumers feel that the repayments are a burden. This points to a need to cushion consumers, especially because incomes have reduced causing at least 63% of consumers to borrow from family/friends or use their savings to cope with the Covid 19 pandemic.

- With companies in financial distress, only 10% of PAYG were able to extend financial support to consumers. Moreover, the burden on consumers is likely to get worse as predictions by World Bank show that Covid-19 will likely push between 71-100 million people into extreme poverty.

- SDG 7 is at risk: At least five surveys focusing on companies have been conducted since March 2020. The results show that 85% of the companies will not survive more than 5 months. This will have a significant negative effect on energy access among the rural population and job losses.

- All the surveys show that majority of the OGS companies (large and small; distributors, PAYG, manufacturers) are in financial distress. Sales for the first six months of 2020 dropped by more than one million units when compared to the same period in 2019. Access to finance is identified as the most significant challenge. Stand-alone solar and mini-grid companies are more affected than biogas and cookstove companies. In terms of geographical regions, East Africa seems to be hardest hit – 50% of the companies in the region can only survive for 1-2 months, while 15% can no longer sustain their businesses. Investors and the support ecosystem need to move with speed to address this situation. In terms of business models, distributors are severely affected.

- What companies need most is short-term grant relief, followed by long-term equity/debt and concessional loans. So far only about 30% of companies have received assistance from government agencies (central/state/provincial/local government authorities), and 17% of companies have accessed relief funds.

WHAT ACTION IS NEEDED?

Inclusion of OGS in economic recovery plans

African governments should include OGS in their recover better economic plans because greater deployment of OGS will lead to:

- Cost effective electricity access: especially for remote, vulnerable and underserved population segments. Off-grid solar has been identified as the least-cost and expedient electrification pathway for the rural populations in Sub-Saharan Africa.

- Powering jobs: Off-grid renewables could create 4.5 million jobs in Africa and Asia by 2030, while solar home systems could create 1.3 million jobs in the same region by 2022. Furthermore, renewables are creating opportunities for integrating more women and youth in the value chain.

- Powering opportunity: Evidence from sub-Saharan Africa and South Asia shows that between 12-34% of people with solar home systems undertake additional economic activities, 11-28% generate additional monthly income of up to $ 31-65. Furthermore, jobs are created at household level. For for every 100 SHS sold, in East Africa 21 jobs were created, 8 in West Africa and 4 in Asia. In East Africa, 52% of these jobs were held by women.

- Productive use of off-grid solar: holds great promise in generating additional income that consumers can use to pay for electricity and improve their livelihoods. This ranges from phone charging businesses to powering appliances such as televisions, dryers, irrigation pumps and grain mills.

- Reduction in carbon emissions: Governments have a greater role to play in supporting transitions towards net-zero emissions. Currently, power and heavy industry together account for about 60% of global emissions. Accordingly, the International Energy Agency notes, ‘achieving global energy and climate goals will demand dramatic scaling up of renewable energy technologies like solar’ Replacing kerosene lighting with solar home systems could reduce a household’s carbon emissions by 45kg a year.

Appropriate financing

Consumers need cushioning so that they do not slide back to an ‘unelectrified state’ as they struggle to allocate diminishing incomes to competing needs like food, rent, healthcare, education and lighting. Governments and development partners should deploy demand side subsidies which directly benefit consumers and will go a long way in ‘keeping the lights on’ and increasing electricity access among vulnerable population segments.

OGS companies need relief funding to keep the lights on for those who are already electrified and to reach new consumers. Funding is also required for companies to meet their operating costs as revenues decrease. Additionally, attention needs to be paid to smaller companies that have been severely affected by the Covid-19 pandemic, yet the financing available does not meet their needs. However, some progress is being made through initiatives such as the Energy Access Relief Response.

More international finance is required for Africa to make progress on universal energy access targets especially in the post Covid-19 era. Even before the pandemic, the amount of international finance going to the off-grid sector had flattened at 12% since 2018.

Local currency financing is needed to address the problem of limited access to capital for locally owned off-grid companies. In addition, technical assistance and first loss facilities are needed to bridge the gap between local financial institutions and the locally owned off-grid companies.

Coordination

In the same way that Covid-19 has re-shaped the way we work, how do the various actors supporting the OGS work together so that ‘the sum of the total is greater than its parts?’ National coordination mechanisms need to be revived or established so that all efforts towards universal energy access are harmonised and recognised as contributing to national electrification targets. Cross-sector linkages and multi-stakeholder partnerships are part of the enabling environment that will be required to expand electricity access and support governments in implementing recovery plans.

You can read or download the full report here.